Can U Charge Tenany Loss Of Rental Income Due To Damage Repairs

The brusque respond is it depends. We recommend requiring renters insurance from your tenants to increase your protection.

If your tenant damages your rental property, your landlord insurance may cover the loss, but it depends on the type of damage and your coverages. Insurance companies categorize damage from tenants in three dissimilar ways:

Accidental impairment

This is just what it sounds like. Anything the tenant does accidentally, such as starting a kitchen fire or breaking a window, falls in this category. Adventitious fires will be covered under whatsoever type of landlord insurance; notwithstanding, other amercement volition depend on your policy.

Your policy may also protect you if the damage leads to a loss of rental income. Your landlord insurance volition not cover replacing your tenants' personal belongings. They'll demand renters insurance to protect their stuff.

Intentional harm

This is also sometimes called malicious damage. This blazon of damage arises when a lousy tenant steals from your holding or takes a sledgehammer to the walls. Your coverage hither again depends on the insurer and the terms of your policy.

People ofttimes confuse this damage with vandalism, which is covered in most policies. But it's important to note that some policies treat intentional damage and vandalism differently.

Wear and tear

This means items such every bit stained carpets or scuffed floors, which are not covered by landlord insurance policies. A mutual way to cover this equally a landlord is to use the tenant's security eolith on such damages.

What's covered and the corporeality of coverage depends on the type of landlord insurance policy. Like the different homeowner's insurance policies, in that location are 3 levels of landlord insurance policies. Insurers telephone call them basic habitation holding insurance, sometimes chosen burn down insurance (DP-1), broad habitation holding insurance (DP-2), and special abode landlord insurance (DP-3).

The corporeality or extent of the home coverage and additional coverages increase with each programme. For example, you can upgrade to replacement price versus actual cash value.

What else does landlord insurance cover?

The iii most significant protections that landlord insurance grants are belongings impairment coverage, liability coverage, and rental income protection:

Property damage

The insurance provider will pay for repair costs to your rental holding for whatsoever covered losses. The standard list of covered perils includes:

- Fire

- Lightning

- Explosion

- Windstorm

- Hail

- Freezing pipes

- Water damage

- and several other less common reasons

However, please annotation landlord policies don't cover losses from floods and earthquakes. (You can buy flood insurance and convulsion insurance besides your landlord policy.)

Liability Insurance

Landlord liability insurance typically just gives coverage for claims related to your rental. Contrast information technology with your principal residence'due south homeowners policy, which covers you and your alive-in family from claims resulting from accidents at dwelling house or elsewhere.

Rental Income Protection

Rental income protection, also called rental reimbursement or fair rental value, pays you the hire you'd miss from a tenant while your home gets repaired later on a merits. Many policies cap the coverage at 12 months of lost rent.

Sometimes landlords call back the policy covers the tenant'south brusk-term living expenses while elsewhere. They would demand a renters policy for that, and this issue adds one more reason many landlords crave their tenants to purchase renters insurance.

Plus, you tin decrease the chance of the loss of your rental income and lower your liability. All these benefits prompt us to highly recommend you lot crave your tenants to buy renters insurance.

Will renters insurance cover belongings harm?

Both tenants and landlords often have misconceptions well-nigh how renter'south insurance works. Generally, renters insurance will merely cover the tenants' possessions and liability if a invitee sustains an injury. Renters insurance will typically not comprehend any devastation to the building, such as fire damages to the kitchen.

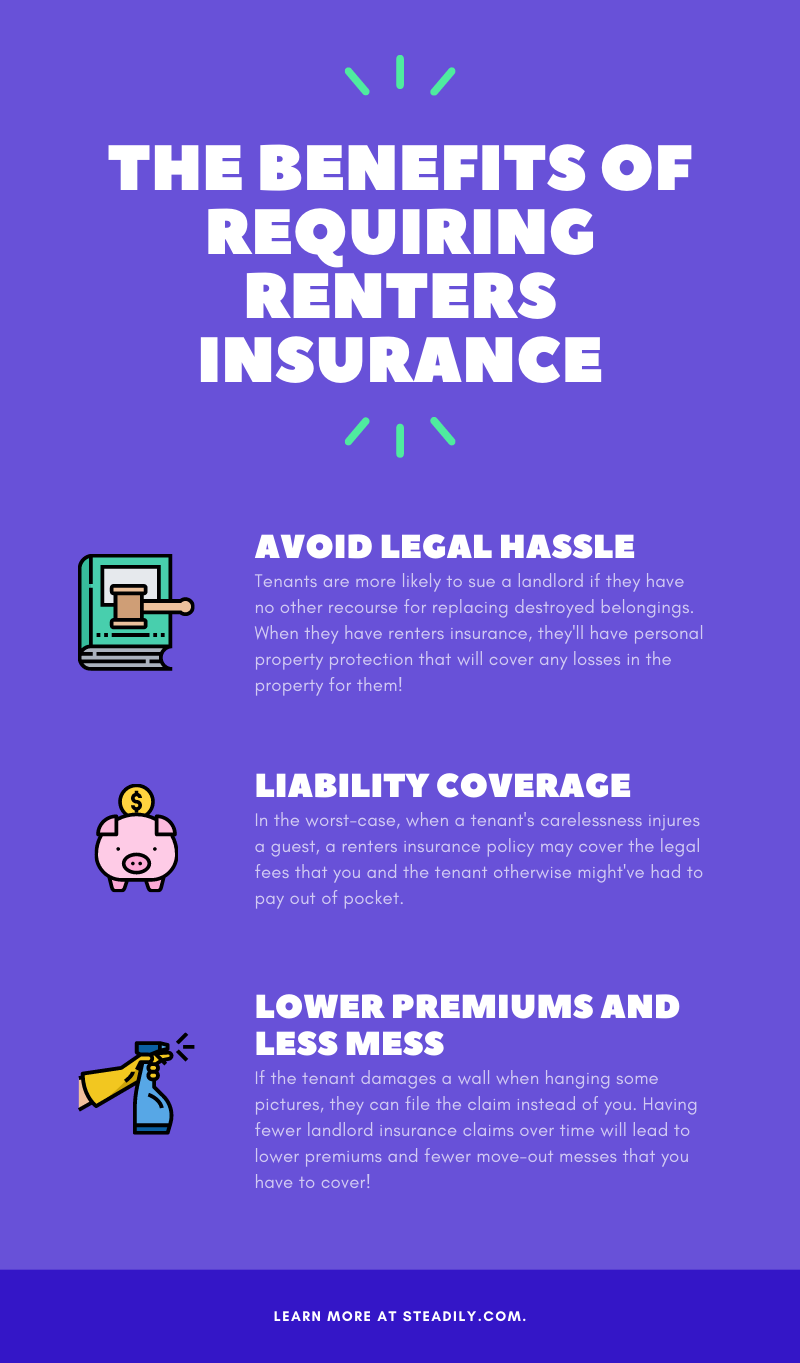

Nosotros recommend that y'all require your tenants to buy renters insurance, even if you have landlord insurance. Why? It reduces the chance that tenants and their guests will sue you for injuries or personal holding harm. In the worst-case, when a tenant's carelessness injures a guest, a renters insurance policy may encompass the legal fees that yous and the tenant otherwise might've had to pay out of pocket.

Your landlord liability policy won't encompass the loss if the tenant'southward carelessness damages the structure or injures someone. However, suppose your tenants have renters insurance. In that case, information technology volition pay for their lost possessions and cover medical expenses for invitee injuries, calculation a layer of protection for both the tenant and yous, the belongings owner.

Your tenants' renters insurance policy can also help prevent an increase in your premiums because it reduces the number of claims you need to file with your landlord insurance. Landlord insurance premiums may increase after a claim, or you tin can even lose the ability to renew if you have too many.

When tenants take renters insurance, they'll file a claim instead of you lot in many situations. For example, if a tenants' invitee slips and falls from a potable spilled in the kitchen, they can file a claim to pay their friend'south medical expenses. Otherwise, you lot would end upward the bailiwick of a lawsuit and need to brand a claim on your landlord policy.

Some other case to see both policies in action, imagine that a tornado hits your rental and destroys part of the structure and your tenant's personal property. Your landlord insurance would cover repairing the property because natural disasters are a covered loss. Your tenant'southward renter insurance, not your landlord policy, would pay for their damaged personal holding.

Gratis Resource: Nosotros wrote an Ultimate Guide to Landlord Insurance. It gives a squeamish overview of what landlord insurance is.

Do I really need to take landlord insurance and a renters insurance requirement?

Our recommendation is yes, and nearly insurance agents would hold. The all-time way to protect your holding and income is to make sure y'all have a landlord insurance policy and crave your tenants to have renters insurance. You'll reduce the chance of an uncovered loss and the likelihood that somebody comes after you for damages because of your tenants' carelessness.

Your tenant's renters insurance liability coverage may aid you lot skip filing a claim. A skilful example arises when the renter'southward insurance covers medical payments for a tenant's guest's injuries.

What's the difference between homeowners insurance, renters insurance, and landlord insurance coverage for personal property?

As a bit of a recap and aid before you get an insurance quote, you lot can pause down each type of coverage this way:

- Homeowners insurance covers your personal property (non business property) anywhere in the world, but the protection comes from the policy on your primary residence.

- Renters insurance takes care of your tenants' possessions anywhere in the world and protects the renters' belongings at your property.

- Landlord insurance has no personal belongings coverage except for rental-related items left on-site such as a lawnmower or maintenance equipment.

- According to the Insurance Information Constitute, insurance costs for landlord insurance is almost 25% more than expensive than home insurance, and renters insurance falls betwixt $150 and $250 per year.

Source: https://www.steadily.com/faq/tenant-damage-covered

Posted by: lauriawhissely.blogspot.com

0 Response to "Can U Charge Tenany Loss Of Rental Income Due To Damage Repairs"

Post a Comment